So many in the public are concerned about who has the best real estate app. We at Windermere Real Estate want to make sure we have the best real estate professionals to help you with the process. An app or a Windermere professional…it’s an easy choice.

Real Estate Market Activity for Snohomish County

I hear from many of our agents that many of their buyers are waiting for the prices to plummet before they purchase a home. With unemployment at such a high level and so many people losing their small businesses, the housing market just has to go down.

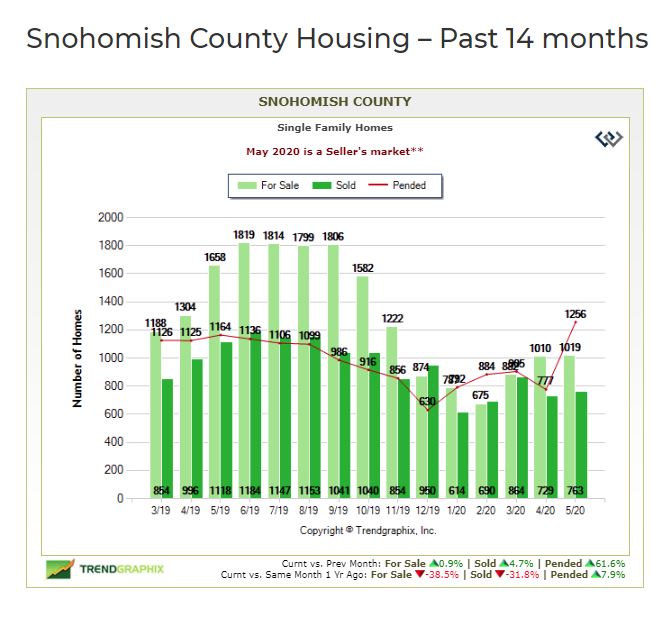

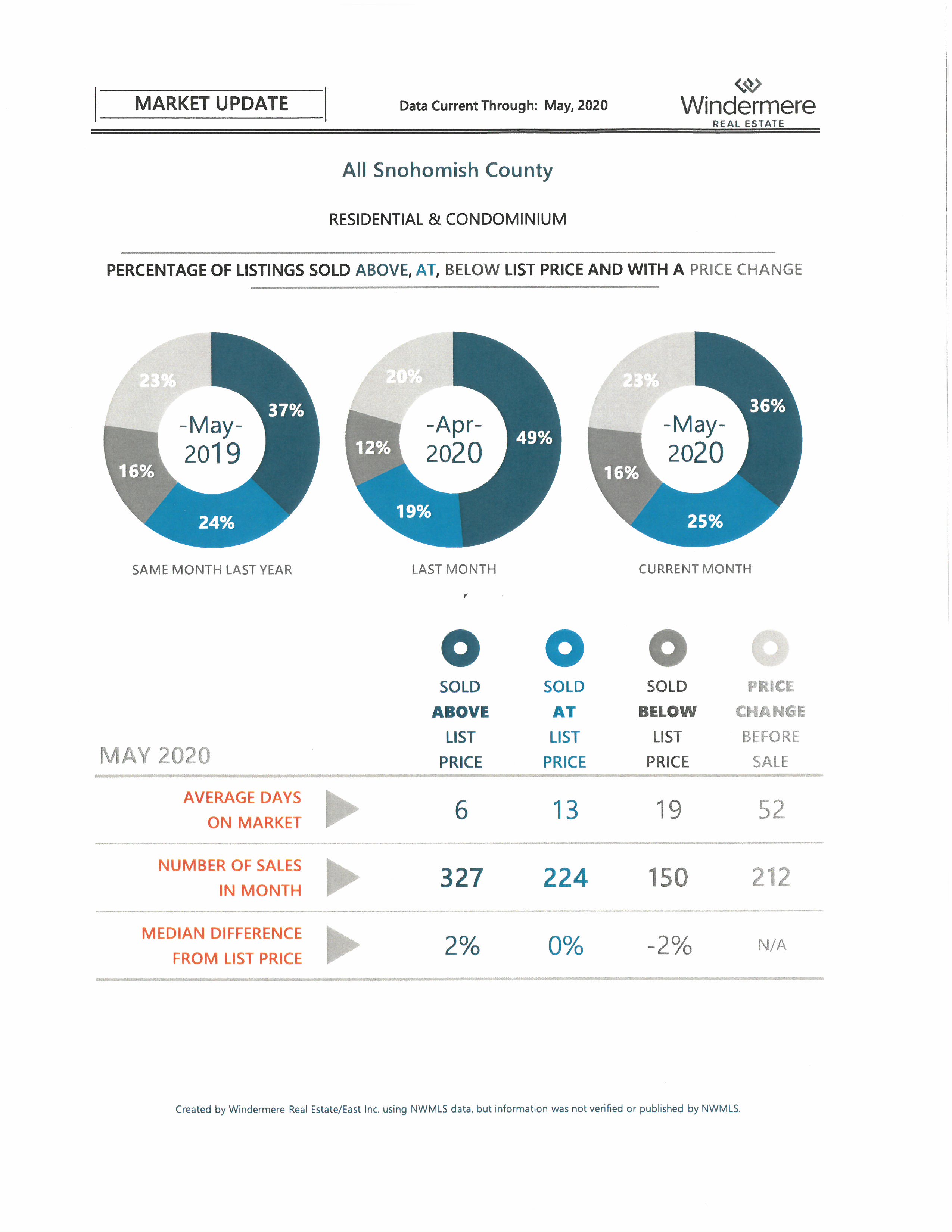

Let’s look at the numbers in Snohomish County for the month of May. Out of the 701 homes that sold, 46.6% of them sold for OVER list price, with an average market time of 6 days. And another 32% sold at the listed price. That, my friends, is the definition of a hot market.

One of the best indicators of a real estate market is by looking at the pending sales. For the month of May, pending sales were up 7.9% to last year…and a whopping 61.6% higher than the month of April. While the number of listings are down, those that put there homes on the market are selling…and fast.

Money raised for Food Banks

In less than one month, Windermere Real Estate, through the Windermere Foundation, raised and donated $690,000. This money is given to organizations that provide food to local foodbanks throughout the state. The need during this time of crisis, is greater than ever. Please support your local foodbanks.

Still moving your dreams forward

Windermere’s highest priority has always

been our unwavering commitment to the

communities where we work, live, and play.

As the COVID-19 pandemic continues to develop,

we are following recommendations from public

health officials and government agencies to

ensure we are helping reduce its impact.

Ensuring that our agents, office staff, and clients

are safe and healthy is our top priority.

Over the past few weeks, we have seen

countless examples of our agents and offices

embodying what it means to be All In, for you.

We are finding creative ways to connect during

this time of social distancing, we are donating time

and money to those in need, we are adapting so

that our agents can continue to help their clients

move their lives forward in these uncertain times.

Everyone in the Windermere family is here

to support and assist you through COVID-19

and beyond. We wish you all good health.

All in, for community

All in, for you.

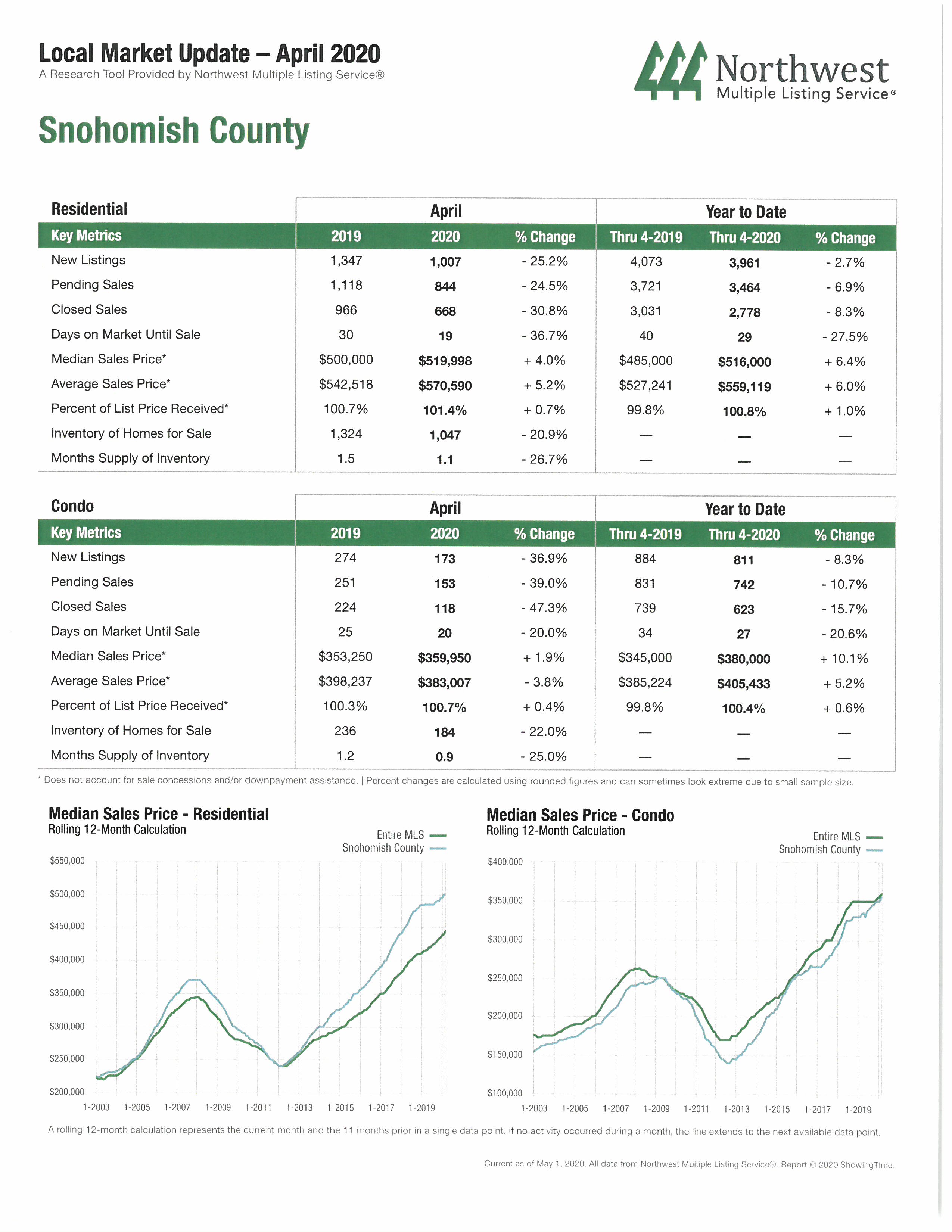

Real Estate Stats for April

A few interesting real estate stats from last month in Snohomish County. Pending sales were down almost 25% from a year ago, but so were new listings. The sales ratio really didn’t change. The # of days on market actually dropped significantly from a year ago and the average sales price rose by about 5%. So, is the market soft or slowing down? Is this a bad time to sell? I would say the answer to both is NO. You can see more info on specific cities on our website.

Raising money to support the food banks

Windermere Real Estate, the largest regional real estate company in the western U.S. with more than 300 offices in 10 states, is challenging its brokers, franchise owners, staff members to raise money for food banks heavily impacted by the coronavirus.

This community initiative, called “Neighbors in Need,” takes the place of Windermere’s annual Community Service Day, a 35-year company tradition. Every June, Windermere closes its doors and its 9,000-member team volunteers in local neighborhoods.

“There is one constant in this pandemic and it’s that people who struggle with poverty are having difficulty getting their most basic needs met,” said Christine Wood, executive director of the Windermere Foundation. “So, our mission at Windermere is to help our local food banks keep their shelves stocked and food on the table through our ‘Neighbors in Need’ fundraising campaign.”

Between now and May 5, the Windermere Foundation is matching every dollar its offices raise, up to $250,000, with the goal of donating at least $500,000 to food banks in the communities where Windermere operates. In the greater Seattle area, those dollars will go to Food Lifeline, Northwest Harvest, and Second Harvest, which then distribute food to hundreds of food banks across the state.

Launched last week, the fund has raised more than $211,000 from brokers, clients and other businesses.

“We hope this will inspire other companies to do this too,” Windermere Vice President Shelley Rossi said. “We know we will exceed our goal. This heartwarming and humbling.”

The Windermere Foundation has raised more than $41 million since 1989 for nonprofits that help low-income and homeless families.

Recession? Yes. Housing Crash? No.

With over 90% of Americans now under a shelter-in-place order, many experts are warning that the American economy is heading toward a recession, if it’s not in one already. What does that mean to the residential real estate market?

What is a recession?

According to the National Bureau of Economic Research:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

COVID-19 hit the pause button on the American economy in the middle of March. Goldman Sachs, JP Morgan, and Morgan Stanley are all calling for a deep dive in the economy in the second quarter of this year. Though we may not yet be in a recession by the technical definition of the word today, most believe history will show we were in one from April to June.

Does that mean we’re headed for another housing crash?

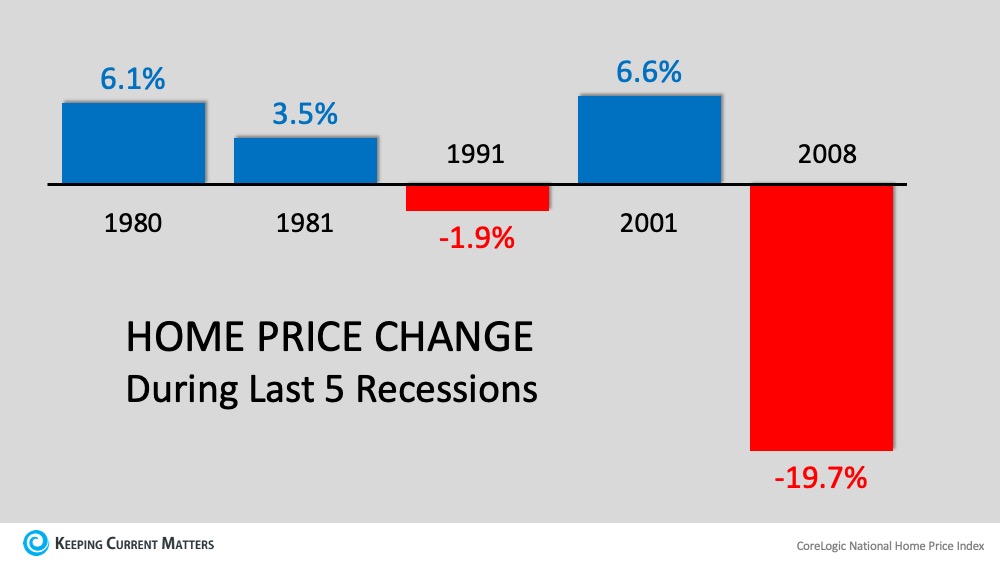

Many fear a recession will mean a repeat of the housing crash that occurred during the Great Recession of 2006-2008. The past, however, shows us that most recessions do not adversely impact home values. Doug Brien, CEO of Mynd Property Management, explains:

“With the exception of two recessions, the Great Recession from 2007-2009, & the Gulf War recession from 1990-1991, no other recessions have impacted the U.S. housing market, according to Freddie Mac Home Price Index data collected from 1975 to 2018.”

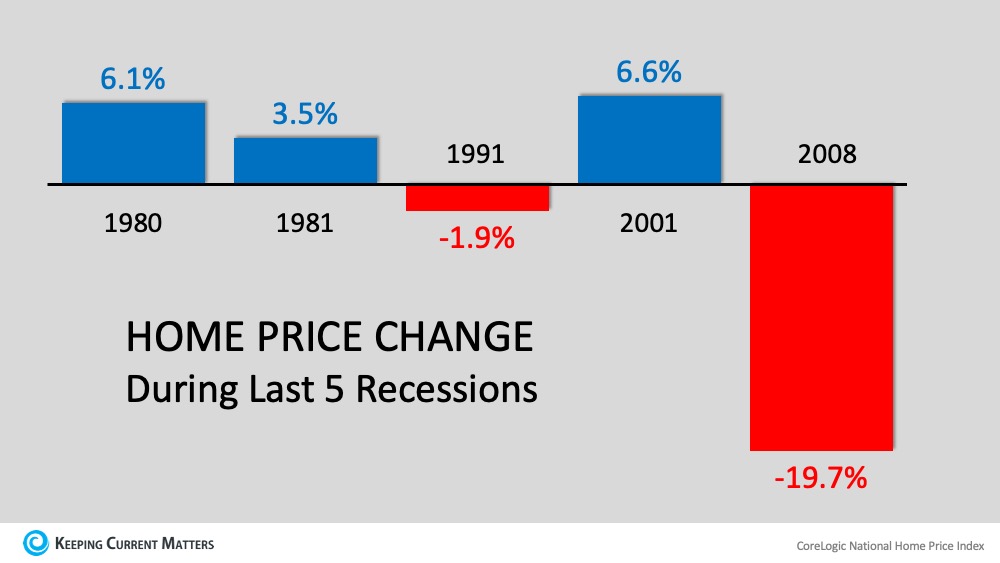

CoreLogic, in a second study of the last five recessions, found the same. Here’s a graph of their findings:

What are the experts saying this time?

This is what three economic leaders are saying about the housing connection to this recession:

Robert Dietz, Chief Economist with NAHB

“The housing sector enters this recession underbuilt rather than overbuilt…That means as the economy rebounds – which it will at some stage – housing is set to help lead the way out.”

Ali Wolf, Chief Economist with Meyers Research

“Last time housing led the recession…This time it’s poised to bring us out. This is the Great Recession for leisure, hospitality, trade and transportation in that this recession will feel as bad as the Great Recession did to housing.”

John Burns, founder of John Burns Consulting, also revealed that his firm’s research concluded that recessions caused by a pandemic usually do not significantly impact home values:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices).”

Is the housing market going to crash?

If we’re not in a recession yet, we’re about to be in one. This time, however, housing will be the sector that actually leads the economic recovery. If you have questions about how this affects your real estate assets, contact one of our talented Windermere agents.

Western Washington Real Estate Market Update – 3rd Qtr

The Gardner Report by Matthew Gardner

The following analysis of the Western Washington real estate market update is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Washington State employment has softened slightly to an annual growth rate of 2%, which is still a respectable number compared to other West Coast states and the country as a whole. In all, I expect that Washington will continue to add jobs at a reasonable rate though it is clear that businesses are starting to feel the effects of the trade war with China and this is impacting hiring practices. The state unemployment rate was 4.6%, marginally higher than the 4.4% level of a year ago. My most recent economic forecast suggests that statewide job growth in 2019 will rise by 2.2%, with a total of 88,400 new jobs created.

HOME SALES

- There were 22,685 home sales during the third quarter of 2019, representing a slight increase of 0.8% from the same period in 2018 and essentially at the same level as in the second quarter.

- Listing activity — which rose substantially from the middle of last year — appears to have settled down. This is likely to slow sales as there is less choice in the market.

- Compared to the third quarter of 2018, sales rose in five counties, remained static in one, and dropped in nine. The greatest growth was in Skagit and Clallam counties. Jefferson, Kitsap, and Cowlitz counties experienced significant declines.

- The average number of homes for sale rose 11% between the second and third quarters. However, inventory is 14% lower than in the same quarter of 2018. In fact, no county contained in this report had more homes for sale in the third quarter than a year ago.

HOME PRICES

- Home price growth in Western Washington notched a little higher in the third quarter, with average prices 4.2% higher than a year ago. The average sales price in Western Washington was $523,016. It is worth noting, though, that prices were down 3.3% compared to the second quarter of this year.

- Home prices were higher in every county except Island, though the decline there was very small.

- When compared to the same period a year ago, price growth was strongest in Grays Harbor County, where home prices were up 22%. San Juan, Jefferson, and Cowlitz counties also saw double-digit price increases.

- Affordability issues are driving buyers further out which is resulting in above-average price growth in outlying markets. I expect home prices to continue appreciating as we move through 2020, but the pace of growth will continue to slow.

DAYS ON MARKET

- The average number of days it took to sell a home dropped one day when compared to the third quarter of 2018.

- Thurston County was the tightest market in Western Washington, with homes taking an average of only 20 days to sell. There were six counties where the length of time it took to sell a home dropped compared to the same period a year ago. Market time rose in six counties, while two counties were unchanged.

- Across the entire region, it took an average of 38 days to sell a home in the third quarter. This was down 3 days compared to the second quarter of this year.

- Market time remains below the long-term average across the region and this trend is likely to continue until more inventory comes to market, which I do not expect will happen until next spring.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. I am leaving the needle in the same position as the first and second quarters, as demand appears to still be strong.

The market continues to benefit from low mortgage rates. The average 30-year fixed rates is currently around 3.6% and is unlikely to rise significantly anytime soon. Even as borrowing costs remain very competitive, it’s clear buyers are not necessarily jumping at any home that comes on the market. Although it’s still a sellers’ market, buyers have become increasingly price-conscious which is reflected in slowing home price growth. If you have further questions about what the Western Washington real estate market update means for you, please contact one of our agents.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link